The Concept of Tempered Price Understanding Its Implications in Modern Economics

In the rapidly shifting landscape of global economics, the term tempered price emerges as a crucial concept with far-reaching implications. While the term itself might not be immediately recognizable to the average consumer, it encapsulates essential ideas relating to price formation, market behavior, and economic balance. This article explores the definition of tempered price, its significance in various markets, and the broader economic implications it embodies.

Defining Tempered Price

At its core, a tempered price refers to a price that is moderated or controlled, often through various mechanisms that prevent extreme fluctuations in response to market forces. This moderation can stem from governmental intervention, market regulations, or even social norms that influence how prices are set and adjusted. The objective of a tempered price is to create stability in an economy, providing consumers and producers with a predictable environment in which to operate.

The Role of Government Intervention

Government policies often play a crucial role in maintaining tempered prices, particularly in essential industries such as healthcare, energy, and housing. For instance, in many countries, governments impose price controls on basic necessities to protect consumers from price gouging during crises, such as natural disasters or pandemics. These interventions help ensure that all members of society have access to essential goods and services, regardless of their economic situation.

Additionally, subsidization is another tool used by governments to stabilize prices. By providing financial assistance to certain industries, governments can help maintain lower prices for consumers while ensuring that producers remain viable. For instance, agricultural subsidies are often used to temper the prices of food products, ensuring that they remain affordable for the average consumer while supporting farmers.

Market Dynamics and Consumer Behavior

The concept of tempered price also reflects how market dynamics interact with consumer behavior. In volatile markets, such as the stock market or the housing market, prices can fluctuate dramatically based on speculative trading, economic reports, or changes in interest rates. However, when tempered pricing is applied—either through regulations or market stabilization strategies—volatility can be reduced, leading to increased consumer confidence.

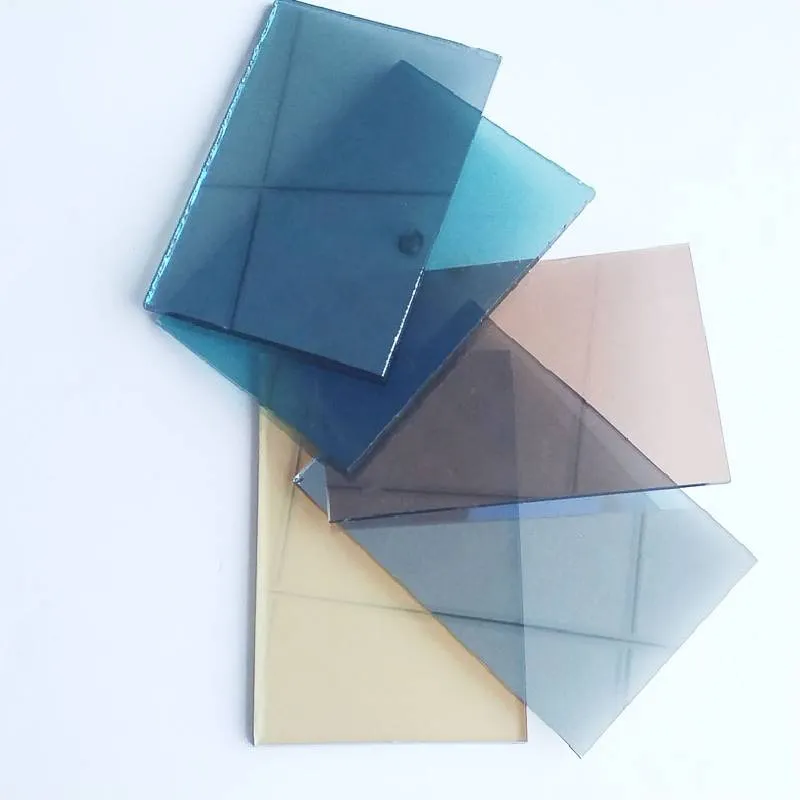

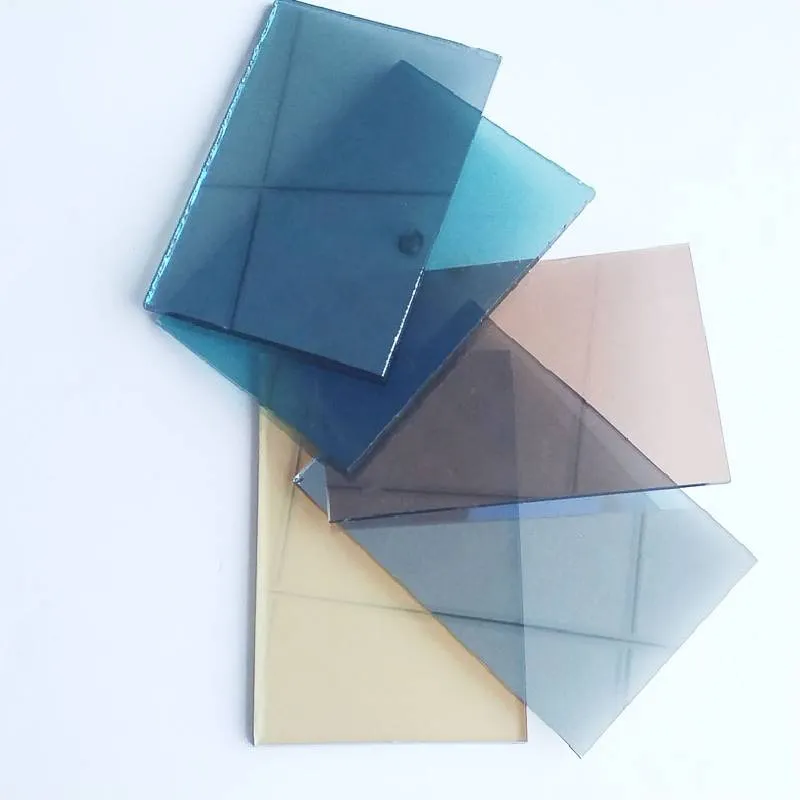

tempered price

Consumers tend to react differently based on the perceived stability of prices. If prices are stable, consumers are more likely to make long-term purchasing decisions, reflecting a positive sentiment towards the economy. Conversely, if prices are fluctuating wildly, consumers may hold back on spending, fearing that prices will drop further or that they might not be able to afford essential goods.

The Implications for Inflation and Economic Growth

Tempered prices can have a profound impact on inflation rates and overall economic growth. In periods of unchecked inflation, prices can rise dramatically, leading to a decrease in purchasing power. Economies can become destabilized when consumer prices rise faster than wages, leading to increased inequality and social unrest. However, when tempered pricing mechanisms are in place, they can help to mitigate these inflationary pressures.

Moreover, tempered prices contribute to sustainable economic growth. When prices are stable, businesses can invest and plan for the future with greater confidence, leading to innovation and expansion. A stable price environment encourages lending and investment, which are essential components of a thriving economy.

Challenges and Criticisms of Tempered Pricing

Despite its benefits, tempered pricing is not without its challenges and criticisms. Some argue that government interventions can lead to market distortions, resulting in inefficiencies and misallocations of resources. For example, prolonged price controls may discourage production, leading to shortages in supply. Critics also highlight that when prices are artificially tempered, it can hide underlying economic problems, delaying necessary adjustments.

Conclusion

In conclusion, the concept of tempered price serves as a vital mechanism for achieving economic stability and promoting consumer welfare. By balancing the forces of supply and demand through moderated pricing strategies, economies can protect consumers, encourage investment, and foster long-term growth. While tempered prices are not a panacea for all economic challenges, their careful application can help navigate the complexities of modern markets, ensuring a more equitable and stable economic environment for all. As we progress in an ever-evolving economic landscape, understanding the nuances of tempered pricing will remain essential for policymakers, businesses, and consumers alike.

Afrikaans

Afrikaans  Albanian

Albanian  Amharic

Amharic  Arabic

Arabic  Armenian

Armenian  Azerbaijani

Azerbaijani  Basque

Basque  Belarusian

Belarusian  Bengali

Bengali  Bosnian

Bosnian  Bulgarian

Bulgarian  Catalan

Catalan  Cebuano

Cebuano  Corsican

Corsican  Croatian

Croatian  Czech

Czech  Danish

Danish  Dutch

Dutch  English

English  Esperanto

Esperanto  Estonian

Estonian  Finnish

Finnish  French

French  Frisian

Frisian  Galician

Galician  Georgian

Georgian  German

German  Greek

Greek  Gujarati

Gujarati  Haitian Creole

Haitian Creole  hausa

hausa  hawaiian

hawaiian  Hebrew

Hebrew  Hindi

Hindi  Miao

Miao  Hungarian

Hungarian  Icelandic

Icelandic  igbo

igbo  Indonesian

Indonesian  irish

irish  Italian

Italian  Japanese

Japanese  Javanese

Javanese  Kannada

Kannada  kazakh

kazakh  Khmer

Khmer  Rwandese

Rwandese  Korean

Korean  Kurdish

Kurdish  Kyrgyz

Kyrgyz  Lao

Lao  Latin

Latin  Latvian

Latvian  Lithuanian

Lithuanian  Luxembourgish

Luxembourgish  Macedonian

Macedonian  Malgashi

Malgashi  Malay

Malay  Malayalam

Malayalam  Maltese

Maltese  Maori

Maori  Marathi

Marathi  Mongolian

Mongolian  Myanmar

Myanmar  Nepali

Nepali  Norwegian

Norwegian  Norwegian

Norwegian  Occitan

Occitan  Pashto

Pashto  Persian

Persian  Polish

Polish  Portuguese

Portuguese  Punjabi

Punjabi  Romanian

Romanian  Russian

Russian  Samoan

Samoan  Scottish Gaelic

Scottish Gaelic  Serbian

Serbian  Sesotho

Sesotho  Shona

Shona  Sindhi

Sindhi  Sinhala

Sinhala  Slovak

Slovak  Slovenian

Slovenian  Somali

Somali  Spanish

Spanish  Sundanese

Sundanese  Swahili

Swahili  Swedish

Swedish  Tagalog

Tagalog  Tajik

Tajik  Tamil

Tamil  Tatar

Tatar  Telugu

Telugu  Thai

Thai  Turkish

Turkish  Turkmen

Turkmen  Ukrainian

Ukrainian  Urdu

Urdu  Uighur

Uighur  Uzbek

Uzbek  Vietnamese

Vietnamese  Welsh

Welsh  Bantu

Bantu  Yiddish

Yiddish  Yoruba

Yoruba  Zulu

Zulu